Trusted U.S. Government Currency Advisor Warns:

Bitcoin $200!

“On April 17, I predict the U.S. will intentionally send Bitcoin plummeting down to $200… and, in the process, unintentionally crash the 401(k)s, IRAs and brokerage accounts of millions of Americans. If you have ANY money in the markets,

DO THIS RIGHT NOW!”

– Jim Rickards

Dear Fellow American,

If your gut tells you Bitcoin investors could lose everything…

That speculating in cryptocurrencies right now is a fool’s errand…

I have to tell you, you couldn’t be more right.

Ironically, being right could cost you everything you own.

Because even if you’ve NEVER invested a PENNY in Bitcoin…

Even if you believe it’s a complete sham…

A coming surprise Bitcoin announcement could put your retirement savings at EQUAL risk as the Bitcoin gamblers.

How is that possible?

Simple. On April 17, 2018, I believe the U.S. government will intentionally do something that could send Bitcoin crashing to $200…

And, in the process, unintentionally destroy the retirement accounts of millions of Americans.

Now, maybe you think this could never happen.

But I’ll tell you from experience, I’ve personally watched a tiny event almost cause a global meltdown from the inside.

My name is Jim Rickards.

I’m an American economist and lawyer.

And although it brings me no pleasure to warn you today…

On April 17, history could repeat itself, when a surprise government Bitcoin announcement unintentionally crashes the whole system…

Slashing your 401(k) in half…

I’m not even the only one who thinks this…

MarketWatch reports: “The bursting of the Bitcoin bubble could ripple far beyond investors.”

Business Insider warns: “Now there is a way for contagion from a Bitcoin price collapse to flow into the rest of the markets.”

And one principal market strategist quietly told CNBC: “If the price of Bitcoin continues to drop, other markets could begin to feel the heat.”

See, while 99% of Americans believe everything is OK…

The smart money is already aware of what’s about to come.

As the ex-chief economist for the Bank for International Settlements puts it:

“All the market indicators right now look very similar to what we saw before the Lehman crisis.”

So what does all this mean for you and your family?

Over the next few moments, I’ll reveal to you exactly how this disastrous situation will unfold…

I’ll show you why the U.S. government would intentionally do something that could harm millions of non-Bitcoin-holding Americans…

And I’ll give you the same financial blueprint that I have already used with more than $1 million of my own money…

So that you can protect and grow your wealth when this hits the fan.

When it comes to worst-case scenarios, I don’t take any chances…

That’s why when the U.S. government wants to know what’s about to happen with the financial markets, I’m the man they call.

For example, in the months after the September 11 attacks in 2001, I was recruited by the CIA to join a top-secret financial project…

The government asked me and my team to build a system that used financial data to possibly predict and thwart the next terrorist attack.

The system we built identified a terrorist event in advance in 2006.

And although my secret clearance prevents me from telling you exactly what happened next, I can show you what was reported in the press…

Check it out, from CNN…

Because of the accuracy of my systems…

The government asked me for help again in 2009, when I was invited to participate in a series of “currency war games” held by the Pentagon.

And then once again in 2016 for another currency war game scenario.

My work speaks for itself in the private sector, too…

Although some of my closest friends don’t even know this about me, I was hired by a hedge fund in the late 1990s as the lead attorney…

Where I organized a private bailout to prevent a complete financial collapse of the world markets… (I’ll get into more detail of that story later and why I’m seeing similarities in the market now.)

Bottom line: I’ve built a reputation for helping the world’s most important agencies prevent worst-case scenarios…

Which is why when I warn you that I believe the government will purposely crash Bitcoin to $200, please know I’m not trying to toot my own horn…

I’ve already made the proper moves to protect myself and my family’s money before the fallout begins.

Today I’d like to help you make the same moves I’ve shown my family members.

Why believe me?

Because my systems have accurately forecast the THREE single biggest

market events of

the last decade…

For instance, the press laughed at me when I predicted that Donald Trump would win the presidency…

Which you can see me do on LIVE T.V. in the one-minute clip below…

Mainstream media outlets like The New York Times declared the likelihood of a Clinton victory at higher than 90%.

But I was right.

Or months earlier, when I was one of the few Americans who confidently predicted that Brexit would actually happen.

You can watch my T.V. prediction here…

At the time, the mainstream media DID NOT see any real chance of this happening either…

In fact, they all felt that the Brexit proposal would simply “recede from view.”

Yet again, I was right.

Or when I forecast the Great Recession of 2008… a little over a YEAR in advance…

At the time, the market was humming to newfound highs. Of course, outlets like The Wall Street Journal simply wanted to tout their success…

“The Dow Jones Industrial Average turned in a banner year, closing near an all-time high.”

Unfortunately, we all know what happened next…

If you had money in the market during the 2008 collapse, you took catastrophic losses.

Again, I was right.

Years later… well after the collapse… they FINALLY listened.

Congress asked me to testify on how dangerous the post-bailout policies of 2008’s crash would be for the average American.

By the time of my testimony, however, it was too late. They should have listened to me earlier.

And that’s why I’m writing to you now, BEFORE the Bitcoin crash and contagion effect sets in.

Listen, you’ve been lied to enough by others. I don’t want you to be caught off guard anymore…

Which makes what I’m about to tell you… what I believe is going to happen on April 17… all the more important…

Here’s how it’s all going to play out, in an event I’m already calling…

The Great Government Bitcoin Extermination

Put simply, on Tuesday, April 17, 2018, the U.S. government is going to make a regulatory move that will purposefully send Bitcoin crashing.

How can I be so certain this will come to pass?

Because of SIX simple words.

The. Government. Always. Gets. Their. Piece.

Remember those words.

Because it’s already happening across the globe.

China has issued a ban on certain cryptocurrencies and demanded three major Chinese Bitcoin exchanges terminate their operations…

Germany’s central bank director has publicly called for global regulations on Bitcoin…

The governor of the Bank of Canada has said trading on Bitcoin is “gambling” and “regulations are needed.”

The prime minister of the United Kingdom has said governments should be monitoring Bitcoin “very seriously.”

And then there’s South Korea…

On January 11, the South Korean government announced it was considering a bill to ban all cryptocurrency trading.

The news sent Bitcoin crashing from a high of $15,018… all the way to $9,402… in just six days.

In other words, Bitcoin fell 37%… erasing more than a THIRD of its total value… in less than a single week.

And that’s just a result of news from South Korea… which handles a measly 3% of the global Bitcoin market.

Imagine what would happen when the U.S.… which controls over TEN TIMES MORE Bitcoin than South Korea … bans Bitcoin.

Well, you don’t have to imagine.

I’ll tell you the same thing I’ll tell the government…

When the U.S. government heavily regulates Bitcoin, it will make that 37% drop look like a small dip.

And that’s exactly what I’m certain will happen on April 17.

Whatever Bitcoin is trading for at the time this note reaches you…

It will drop to $200.

That’s a huge crash…

But you’re safe if you don’t own Bitcoin, right?

Nope.

It’s not that simple anymore.

Markets are as intertwined as ever. One small “sneeze” in a crowded marketplace will make everyone catch the flu.

I’ll show you proof in a moment…

Including why this event will send the global markets into a frenzy…

How it could radically alter your 401(k)… IRA… and brokerage account…

All in the blink of an eye.

But first, let me tell you what’s going to trigger all this… and exactly what the U.S. government is going to do on April 17…

April 17… the day the U.S. government will send Bitcoin

crashing to

$200

The final nail in the coffin for this nightmare scenario will be a series of TWO simple decisions.

Both of which I believe will happen on or around April 17.

And together, these decisions will result in the effective banning of Bitcoin.

First, the U.S. Treasury will decide that the use of Bitcoin violates America’s legal tender laws and make it illegal to use Bitcoin as a form of payment.

See, the government hates competition for the U.S. dollar.

Think they’re going to sit idle and watch a competing currency rise?

Nope.

The. Government. Always. Gets. Their. Piece.

Second, on April 17… it’s Tax Day.

That’s the day it’ll be completely apparent to the U.S. government that Bitcoin traders and payment acceptors HAVE NOT filed the proper taxes on their Bitcoin gains.

And that, my friend, will be the final nail in the coffin…

If they can’t tax Bitcoin… if they can’t get their piece… they’ll be very, very angry.

That’s why the IRS will lay down thousands of pages of new Bitcoin tax reporting regulations.

Consider this…

According to the IRS, between 2013 and 2015, an average of just 832 Americans using Coinbase… the largest U.S. Bitcoin exchange… reported their Bitcoin transactions.

To put that in perspective for you, Coinbase has more than 13.3 million users.

Yet only 832 of them reported paying Bitcoin taxes per year, over a three-year period on average.

That works out to a miniscule 0.0063% of users paying taxes.

Think about the significance of that for a moment…

If only 0.0063% of Americans paid their taxes on stocks…

Don’t you think the government would step in with crippling new tax laws on stocks?

Of course they would.

The same thing is about to happen in Bitcoin…

With millions of Americans potentially facing HUGE fines… or even worse… jail time.

…And what I told you is just what’s happening on Coinbase.

There are loads of other U.S. Bitcoin exchanges too.

See, Uncle Sam doesn’t mess around when it comes to getting paid.

The. Government. Always. Gets. Their. Piece.

Which makes April 17 the perfect time for the government to ban Bitcoin, and end the rampant tax evasion…

When this decision happens, I’m confident we’ll see the price of Bitcoin crash all the way to $200…

Setting the stage for stocks to plummet, and a potential doomsday scenario for your retirement savings.

So if that’s the case… and simply banning Bitcoin could spark a global market collapse… why would the U.S. government go through with it?

The United States government has a proven history of banning “alternative” assets

…And it’s happened much more recently that you’d think.

Fact is, just 85 years ago President Franklin Roosevelt made it illegal for Americans to own gold.

Via Executive Order 6102, he declared offenders faced up to TEN YEARS in federal prison.

Millions of Americans were forced to wait outside their banks to trade their gold in for paper money…

Worse yet, our government literally “stole” this gold from hardworking citizens…

Regular people like you and I.

See, Americans had no choice but to fork over their gold for the demanded price of $20.67 per ounce.

Yet once all the gold was confiscated, President Roosevelt re-priced the precious metal to $35 an ounce.

In other words, the government cheated every American out of 41% of their money.

Why did President Roosevelt ban gold?

Because the government NEEDED MONEY to fund his New Deal programs to try and end the Great Depression…

Remember…

The. Government. Always. Gets. Their. Piece.

And here’s the thing…

Historians know Roosevelt’s New Deal did not bring the country out of the Great Depression (that didn’t happen until World War II)…

What happened instead was that in the years that followed, the stock market CRATERED 90%.

Do you think President Roosevelt intended to send the market to its knees?

Of course not. He wasn’t an evil man.

He truly believed what he was doing wouldn’t have any further consequences.

The same goes for what’s coming on April 17, when the government decides to ban Bitcoin.

See, while the government is gearing up for Bitcoin to crash…

They’re not intending to trigger a global market meltdown…

But that’s exactly what’s going to happen…

The reason?

Contagion.

When Bitcoin “sneezes,” everyone gets the flu

Before I explain why I’m so certain a crashing Bitcoin will trigger a global financial collapse…

Impacting millions of Americans, even those who DON’T own Bitcoin…

Let me first show you how contagion works with something you’re familiar with in your own life…

The flu.

Generally speaking, it all starts with a “Patient Zero”…

A single infected person…

That person sneezes. They cough. They touch something and leave germs.

That gets another person sick…

Then that second person gets a third person sick.

And on and on and on.

Before you know it, the flu has spread to millions of people in America.

Hospitals are overwhelmed. Everyone rushes to get their flu shots, but the medicine cabinets are empty.

No hospital or doctor’s office has any flu shots left.

Those people ignored the initial signs and waited until AFTER the flu spread to try get their shots.

It’s too late. Now they’re infected.

And it’s all because of PATIENT ZERO.

Well, my friend…

Right now Patient Zero for the financial collapse is Bitcoin. And it’s about to begin sneezing on April 17…

Bitcoin $200 =

Dow 10,000

When Bitcoin crashes… that financial distress will quickly spread into the broader financial markets.

I’ve seen it happen firsthand.

Back in September 2007, I was in Tokyo during the early stages of the recent financial crisis…

Japanese stocks were plunging, but no one in Japan knew why.

What was going on, exactly?

It turned out U.S. hedge funds some 6,000 miles away were getting crushed on mortgages.

They were losing billions of dollars…

So they started selling Japanese stocks to cover their losses.

Pretty soon, the whole world was selling everything to raise cash and every world market was plunging.

Well, the same thing is about to happen with Bitcoin.

When the U.S. government bans Bitcoin, causing its price to crash all the way to $200…

Bitcoin investors are going to panic.

They’re going to turn to whatever they can sell to cover their losses…

Stocks, bonds, real estate… you name it.

Fact is, everything that happens in the global markets is connected.

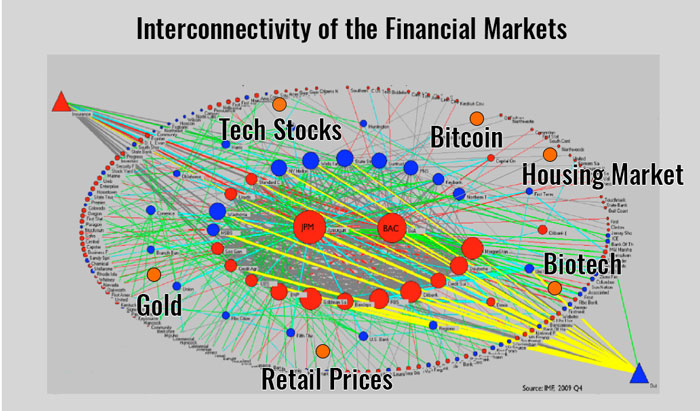

See this chart…

This is what the financial markets look like today.

Whether it’s a gold shock in India… that leads to a drop in retail prices in Switzerland…

Or a meltdown in Canada that causes further damage in Australia…

All of the world’s financial markets are supremely interconnected.

And that’s exactly the way things are setting up with Bitcoin…

A crash in Bitcoin could spark a selloff in biotech stocks… which could in turn send housing prices plummeting… which could collapse the tech market…

And so on…

And I’m not the only one who thinks that…

MarketWatch reports:

Business Insider warns:

And one principal market strategist quietly told CNBC:

But here’s the really scary part…

Bitcoin is EVEN more tied to our financial market than most people realize.

See, the biggest derivatives exchange in the world… the CME Group… which is based in the U.S.…

Recently launched Bitcoin futures.

What that means is that Bitcoin has a direct link for spilling over to the global derivatives market…

A market worth a ridiculous $1.2 quadrillion…

Yes, you read that correctly.

The derivatives market is bigger than the world market for stocks, bonds and gold combined…

In fact, the global derivatives market is so big…

In dollar terms, it’s valued at TWENTY TIMES more than the GDP of Planet Earth.

So when Bitcoin crashes to $200…

It’s just a matter of time before the damage will hit the derivatives market.

And what do you think would happen if a market that’s 20X the GDP of every country in the world suddenly crashed?

You got it — complete financial mayhem.

But if that’s not enough evidence to show you what’s coming, beginning on April 17…

And you’re still asking yourself how I could be so certain this will all come to a head…

I know this is going to happen…

Because I witnessed the same circumstances hit in 1998… when I was forced to organize a private bailout to prevent a complete financial collapse of the world markets…

Back then I was the lead attorney for a Connecticut-based hedge fund, Long-Term Capital Management.

We were one of the world’s largest hedge funds, controlling multiple billions of dollars.

We had two Nobel Prize winners on staff.

And I vividly remember the day it all very suddenly collapsed — all due to a tiny event in a faraway market.

It was Friday, August 21, 1998…

The phone rang at my vacation home on the Outer Banks.

It was from one of the partners of Long-Term Capital Management (LTCM).

He said, “Jim, we lost $500 million yesterday; the partners are meeting Sunday. You should get back for this.”

I immediately packed the car and drove nine hours to Connecticut.

LTCM had 106 trading strategies involving stocks, bonds, currencies and derivatives in 20 countries around the world.

Everything seemed so safe.

Then Russia defaulted on its debt…

And our American-based hedge fund lost billions…

Which quickly spread like the flu to the global financial markets.

Everything was collapsing.

We were rushed into a meeting with New York Fed Chief Peter Fisher… who told us:

“We knew you guys could shut down the bond markets,

but we had no

idea you would shut down the stock markets too.”

So they turned to me, as the fund’s lead attorney, to organize a private bailout among a consortium of Wall Street banks.

As I tell people to this day,

“We were hours away from a total world collapse.”

But that day, the financial system didn’t break down…

Because just before the clock struck midnight on LTCM, I got the deal signed.

Now, I’m not sharing this story with you to brag…

I’m sharing it with you to make one big point:

I’ve personally seen from the inside how seemingly small, unrelated financial items can crash… and almost bring the whole system down with it.

When I say the government is going to purposefully send Bitcoin crashing to $200… and unintentionally crash the entire market…

I’m not making this prediction lightly.

Just how far could stocks fall?

Let’s take a look…

A market wipeout

of 90%…?

What’s at stake for stocks, starting on April 17?

Well, nobody has a crystal ball, but there’s historical precedent for what’s about to happen.

Remember what I told you about the Great Depression?

That’s the last time the U.S. government did something similar to what’s coming April 17…

When they banned the ownership of gold.

The effects couldn’t have been more disastrous… as the market IMPLODED in the years that followed… wiping out 90% of its value.

Imagine waking up and your retirement savings being worth 10 cents on the dollar…

So could the same thing happen again?

Could stocks really fall 90%?

Well, it’s highly unlikely.

But that’s not to say stocks won’t plummet 25%, 35%, even 50% or more…

We’ve seen it happen dozens of times…

Going back to 1980, my research shows there’s been 22 separate world market crashes.

There was the stock market downturn of 2002, when the Dow plunged 27%…

Enough to slash a healthy 401(k) of $100,000 into just $73,000…

In the span of a single year.

There was Black Monday in 1987… where you could’ve lost nearly as much… in just ONE day…

When the Dow cratered 22%.

There was the recent financial crisis, which you know was even more catastrophic…

Where the S&P 500 wiped out HALF its value.

I could go on and on… here’s a snapshot:

- Souk Al-Manakh Stock Market Crash — August 1982

- Black Monday — October 19, 1987

- Rio de Janeiro Stock Exchange Crash — June 1989

- Friday the 13th Mini Crash — October 13, 1989

- Early 1990s Recession — July 1990

- Japanese Asset Price Bubble — 1991

- Black Wednesday — September 16, 1992

- Asian Financial Crisis — July 2, 1997

- Russian Financial Crisis — August 7, 1998

- Dot-Com Bubble — March 10, 2000

- Effects From the September 11 Attacks — September 11, 2001

- Stock Market Downturn of 2002 — October 9, 2002

- Chinese Stock Bubble — February 27, 2007

- The Great Recession — September 16, 2008

- Dubai Debt Standstill — November 27, 2009

- European Sovereign Debt Crisis — April 27, 2010

- 2010 Flash Crash — May 6, 2010

- August Stock Market Fall — August 1, 2011

- Chinese Stock Market Crash — June 12, 2015

- U.S. Stock Market Selloff — August 18, 2015

As the ex-chief economist for the Bank for International Settlements puts it:

“All the market indicators right now look very similar

to what we saw

before the Lehman crisis.”

And here’s the thing…

If you’ve been paying attention to what I’ve told you so far, you know by now it doesn’t matter if you’re not heavily invested in stocks…

Just like it won’t matter on April 17 if you’ve never invested a penny into Bitcoin…

Every American is at risk.

Which is why I urge that you take action now before it’s too late…

Remember, I’ve already made my moves with more than $1 million of my own money.

I’ve already told my family members what to do.

Now I’d like to help you, too…

That’s why I recommend you take three very simple steps to prepare for this massive crash that’s coming on April 17.

The steps I’ve outlined below will protect and grow your wealth.

So, unlike most pundits who never put their money where their mouth is, we’ll BOTH be in these strategies together…

Let’s get started with the first move…

STEP #1:

Get 10% of your assets in precious metals, the correct way

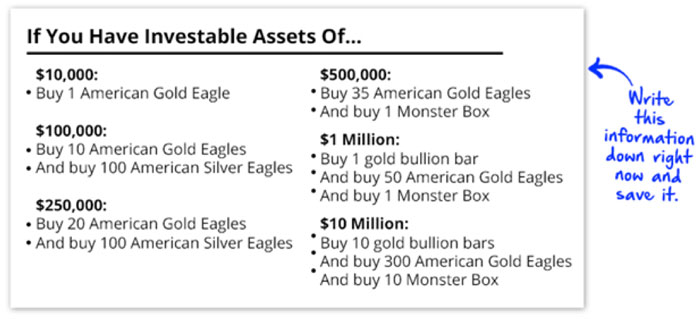

I recommend you immediately put 10% of your investable assets into gold and silver…

President Trump himself owns hundreds of ounces worth of physical gold.

So does his budget chief — along with nearly $1 million in gold investments.

But it pains me to see regular Americans make simple mistakes when buying gold… or get suckered into buying collectible gold coins.

To avoid any confusion, I’ve created this FREE allocation chart for you.

Make sure to follow these guidelines with just gold Eagles, Buffalos and one-kilo gold bars in the amounts below:

But that’s just a starting point…

See, to successfully buy physical gold, you need to know A WHOLE LOT MORE than just what I’ve shown you here…

For example, how do you calculate your investable assets?

Do you count your house?

And who do you buy these coins and bars from?

How do you make sure you’re paying the lowest commissions?

And where do you store all your precious metals?

There are a lot of questions to answer when buying physical gold — and it’s critical you get it right.

That’s why I’ve put together a complete guide to answer all of these questions for you… in an urgent dossier called The Perfect Gold Portfolio.

It gives you a road map for buying physical gold no matter if you’re investing $1,000 or $1 million.

It also includes access to my proprietary Rickards’ Precious Metals Portal, which gives you a one-click way to order and manage your precious metals.

Keep in mind I’m not selling you gold. This is just my recommended parameters for buying and managing physical gold.

I’ll send you this urgent dossier, The Perfect Gold Portfolio, for FREE… as soon as I hear from you today.

Read it carefully, then move directly to taking Step #2…

STEP #2:

Make sure you rid your portfolio of these 51 ticking

time bombs

Do you own a bank stock like Bank of America?

A consumer staple like Best Buy or Starbucks?

How about some popular ETF names?

If so, you’ll want to exit those positions immediately, before the global financial markets come crashing down.

Now, these are some obvious things you DON’T want to own.

But the scary part is this…

My research has led me to find upwards of 51 stocks that ARE NOT so obvious.

Stocks you’ll want to dump right away, if you own them…

And stocks that are unfortunately stuffed in almost every retiree’s investment accounts.

We’re talking big-name stocks that will fall the hardest as the Bitcoin contagion spreads to the broader markets.

I’ve outlined each of these stocks in another dossier I’ll send you today.

It’s called: 51 Ticking Time Bombs That Could Sink Your Retirement .

These 51 stocks will likely lose HALF their value… or more… when the crash hits.

But besides telling you which companies to shed from your portfolio…

I’ll reveal a little-known strategy that could help you bank gains of 1,000%+ as these stocks plummet.

When April 17 rolls around, you’ll be thrilled you have this dossier backing your every move.

And just like the urgent dossier in Step #1…

51 Ticking Time Bombs That Could Sink Your Retirement is yours FREE… the moment I hear from you.

But once you’re finished checking this out, there’s something else you should do…

STEP #3:

Tap the hidden “DV01 strategy” for a potentially endless stream of

double-

digit gains

There is a simple investment… not a stock, a bond, an option, a precious metal or anything you’ve considered buying before…

That offers the opportunity for massive gains to investors in the coming crisis.

In 2008, while most investors watched their portfolios get obliterated…

This hidden investment could’ve DOUBLED your money… FAST…

Without you doing anything outside your regular brokerage account.

Yet even today, most investors haven’t got a clue it exists.

In fact, the only reason I know about it is because of a weird financial phenomenon I uncovered…

While working deep inside the global banking system.

I call it “DV01.” And I believe it’s the closest thing you’ll ever find to a guaranteed winner.

And I’ll detail exactly what this strategy is… and how you can get started exploiting it too…

In another dossier called Tap the Hidden “DV01 Strategy” for a Potentially Endless Stream of Double-Digit Gains .

You can get it FREE as soon as I hear from you…

Plus The Perfect Gold Portfolio…

Plus 51 Ticking Time Bombs That Could Sink Your Retirement …

Keep in mind, I’ve gone ahead and reserved one free copy of each dossier in your name.

They’re on hold, waiting for your response.

But before I send them to you, there’s one more thing you should do:

Join me for an emergency briefing the day before this all goes down…

Because I’m so concerned about what could happen on April 17, I’m holding an emergency briefing the day before, April 16.

During this briefing, I will share the details behind where the market is going… what to watch for… and how to prepare your money.

I’ll reveal what the Federal Reserve’s reaction to this market crash might be…

Why global elites are making secret warnings about the coming crash…

And how it could directly impact your retirement.

Please, just keep in mind I can’t give personalized investment advice.

But I’ll tell you about the latest developments in the markets and how you should prepare accordingly.

Tickets to a briefing like this typically cost a small fortune…

I normally charge $25,000 or more to speak at investment conferences.

But today you have the chance to join this briefing… free of charge.

I’ll tell my team to give you access and send you everything I promised above when you agree to a risk-free trial of my flagship research service…

Introducing…

Jim Rickards’ Strategic Intelligence

Even though I constantly appear on everything from CNBC to Fox and CNN, there’s been a serious problem…

Those venues don’t allow me to share my most sensitive moneymaking moves.

And that’s important, because today we have a very dangerous situation…

Things are volatile, and I believe the market will change very quickly.

So I’ve been looking for a venue where I could help my readers on an ongoing basis as this crisis unfolds…

Telling them where to invest and how to avoid the pitfalls.

That’s why I decided to launch Jim Rickards’ Strategic Intelligence.

Strategic Intelligence is a 100% independent research service with two big goals:

- First, it leverages my decades of experience helping the world’s most important agencies prevent worst-case scenarios…

- Second, it’s simple enough to understand that I can show ordinary Americans how to protect and grow their wealth… regardless of the broader markets.

We’re 100% independent.

That means we NEVER accept a dime from any media organization to peddle their fake news.

It also means we NEVER take any payments from any company to cover their stock.

As a member of Strategic Intelligence, every month you’ll receive urgent market insight from me on how this situation is unfolding.

I’ll warn you about the market’s current trajectory…

And give you at least two to three recommendations and wealth-protection plays each month that will help you profit even during the meltdown.

Until now, I have only provided this kind of service to my high-net-worth clients and members of the U.S. intelligence community.

But with Strategic Intelligence, you too will have the opportunity to hear my best investing ideas.

And it’s important to note this will be the exclusive place to receive my monthly issues and alerts.

This research service IS NOT available anywhere else in the world, at any price.

I strongly suggest you follow the three steps and claim the FREE dossiers I told you about above:

- The Perfect Gold Portfolio…

- 51 Ticking Time Bombs That Could Sink Your Retirement …

- Tap the Hidden “DV01 Strategy” for a Potentially Endless Stream of Double-Digit Gains …

Because there isn’t much time left to protect yourself.

It’s NOW or NEVER: April 17 is rapidly approaching

This could be the date you’ll look back on… 20 years from now…

And tell your grandkids that April 17, 2018, was the day you sidestepped a major financial crisis… and made enough money to pay for their entire college education!

The date you made enough money to retire easy…

And travel the world with your spouse.

See, here’s the thing most people don’t realize…

Everyone is a genius during a bull market…

Yet the real genius comes into play for those who know how to make money during a downturn.

That’s how some of the world’s most famous investors have grown their fortunes.

Just look at some of the wealth that exploded out of the recent 2008 financial crisis…

Jamie Dimon did this with JP Morgan… stockpiling huge amounts of lowball assets…

Making himself and shareholders rich as the company has since nearly surged in value 5X over.

Hedge fund manager John Paulson made a whopping $2.5 billion from a single play…

And then went on to make even more money by investing heavily in JP Morgan, among others.

And of course, there was Warren Buffett…

Who racked up untold billions from targeting cheap companies.

Bottom line: If you can determine the right place to put your money, your gains could shoot sky high… even during a crash.

The key is knowing you should never invest more than you can afford to lose.

Now, as you know, the Bitcoin market is extremely volatile…

Meaning things happen FAST.

So while I’m circling April 17 on my calendar…

This could also happen EARLIER!

Remember…

The. Government. Always. Gets. Their. Piece.

My guess is they’ll take their piece in mid-April.

Of course, no one can see the future, and it’s possible this event won’t happen by that date.

But based on my decades working inside the most important government organizations you can find, I have every reason to believe this will come to pass.

Which is why to make sure you’re perfectly positioned when this all goes down…

You’ll have to take immediate action.

So let’s recap everything you’ll get with your risk-free trial of Strategic Intelligence now…

The moment you agree to take a risk-free trial of Strategic Intelligence, you’ll receive:

- 12 Monthly Issues of Strategic Intelligence… Every month you’ll receive urgent market insight from me on how this situation is unfolding… I’ll warn you about the market’s current trajectory… and give you at least two to three recommendations and wealth-protection plays that will help you profit even during the meltdown. ($99 value)

- The Perfect Gold Portfolio … Inside this dossier, you’ll discover exactly how I recommend you immediately put 10% of your investable assets into gold and silver. It’s your complete guide to getting your wealth into these precious metals the right way. And it’s designed to work regardless of whether you’re investing $1,000 or $10,000. ($99 value)

- 51 Ticking Time Bombs That Could Sink Your Retirement … These 51 stocks are unfortunately stuffed in almost every retiree’s portfolio… and will likely lose HALF their value… or more… when the crash hits. But besides telling you which companies to shed from your portfolio… I’ll also reveal a little-known strategy that could help you bank gains of 1,000%+ as these stocks plummet. ($99 value)

- Tap the Hidden “DV01 Strategy” for a Potentially Endless Stream of Double-Digit Gains … In 2008, while most investors watched their portfolios get obliterated… this hidden investment could’ve DOUBLED your money… FAST… without you doing anything outside your regular brokerage account. Yet even today, most investors haven’t got a clue it exists. I believe it’s the closest thing you’ll ever find to a guaranteed winner. And it offers the opportunity for massive gains in the coming crisis. ($99 value)

- April 16 Emergency Briefing Access… Because I’m so concerned about what could happen on April 17, I’m holding an emergency briefing the day before. During this briefing, I will share the details behind where the market is going… what to watch for… and how to prepare your money. I’ll reveal what the Federal Reserve’s reaction to this market crash might be… why global elites are making secret warnings about the coming crash… and how it could directly impact your retirement. ($99 value)

That’s a total of $495 of value.

But it’s worth a whole lot more than that…

I’m confident if you follow the three steps I’m recommending you take right now…

Which you’ll find inside these three dossiers…

And if you join me for this emergency broadcast the day before April 17…

You’ll be in perfect position to not only protect your wealth, but also make a fortune in the coming weeks and months ahead.

Just take a look what some of my 100,000 subscribers of Strategic Intelligence are saying right now…

“Excellent big-picture view of what is happening in the world, backed

up by extensive contacts with actual movers and shakers.”

– Frank G., St Louis, MO

“I’m finally free from so-called ‘financial advisors’ who seem more

interested in padding their own wallets at my expense than offering

advice that can steer me and my family toward financial independence

and self-sufficiency.”

– J. Johnson, Long Beach, CA

“The most valuable and appreciated gift I have drawn from your

recommendations and letters is peace of mind and a better sleep. After

2008 I felt like I was walking through a haunted house for the first

time, trying to brace for every turn, in an attempt to suppress the

jolt of surprise. You remember… that naked, ominous feeling that you

know is inevitable but you can’t do anything to stop. I would put my

head on my pillow every evening feeling that way, wondering if I was

going to wake up and have to start from zero again. I now feel more

secure financially as a provider for my family. That one is the

greatest gift one man can give another in my honest opinion.”

– Mike W., Poughkeepsie, NY

“I have yet to find any other financial publication that speaks the

truth like this.”

– Dave M., Hillsboro, IL

So at this point, you’re probably wondering how much a risk-free trial to Strategic Intelligence costs…

And how you can get started taking back control of your wealth…

Well, I’ll tell you this…

It’s an absolute steal considering that the global markets are about to be pushed to the brink of collapse.

What would you pay for the chance to sidestep disaster?

$1,000… $5,000… $10,000?

Well, the good news is you won’t pay anywhere near that amount.

Not even close.

Not by a long shot.

Before I show you what it costs to get started, let me tell you about one final step I recommend you take immediately…

YOURS FREE:

My brand-new book: Cryptocurrency Wars…

As you may know, I’m the author of New York Times best-seller Currency Wars.

Currency Wars details the coming global financial crisis that America will soon face.

But my brand-new book, Cryptocurrency Wars, takes it one step further…

In it, I reveal what I think will be the ultimate conclusion of the cryptocurrency wars…

The single most important investment to own as cryptos crash…

And what’s going to happen as the world’s governments start to get involved.

Over the coming weeks, I plan to launch Cryptocurrency Wars exclusively in digital form for my readers…

And when it goes live, I’ll set aside one additional copy for you.

This is the ONLY way you can get access to this book… it’s not going to be available for sale anywhere else.

Like your three urgent dossiers and access to my emergency briefing on April 16…

You’ll get your digital copy of Cryptocurrency Wars for FREE when you agree to a risk-free trial of Strategic Intelligence.

Here’s the deal…

Take a RISK-FREE trial of Strategic Intelligence… for just 27 cents per day

A one-year risk-free trial of Strategic Intelligence will cost $99.

That’s an absolute steal considering what’s at stake here…

For just pocket change… 27 cents per day… you can discover how to protect and grow your wealth…

During what could be the worst financial crisis of our lifetimes.

Never before have the world’s markets been so interconnected.

When the U.S. government bans Bitcoin on April 17… purposefully sending it crashing to $200…

Only to watch in horror as the financial distress spills over in the broader markets…

When millions of Americans potentially lose everything…

You’ll be thankful you spent 27 cents per day… to have the backing of Strategic Intelligence.

But because I want my research to reach ordinary Americans who need it the most…

At a time when there’s nobody else looking out for the little guy…

I’ve negotiated a special deal with my publisher to slash the price of Strategic Intelligence in half…

That means instead of paying $99…

You’ll only pay $49.

That means for less than your monthly cable and internet bill you’ll receive access to everything we’ve talked about today.

And here’s the best part…

Because this is a RISK-FREE trial… you’ll have a FULL year to see if Strategic Intelligence is right for you!

At any point during your trial, if you’re not completely satisfied with Strategic Intelligence…

For any reason…

*** You can get a full refund, no questions asked. Even if it’s on the very last day of your membership!

Regardless of what you decide, you keep everything I’m sending you today!

That includes access to all THREE urgent dossiers and your copy of my brand-new book, Cryptocurrency Wars.

That’s how confident I am in my research.

Don’t wait until April 17 to decide…

Remember the flu story earlier…

If you wait until AFTER everyone has the flu, there will be no flu shots left for you. No way to protect yourself.

Those who don’t get sick are the ones who act before the contagion spreads.

The same thing is true in the financial markets.

When Bitcoin plunges to $200…

Which I’m certain will happen on April 17…

It could spell disaster for the global financial markets.

And for millions of Americans who have no idea what’s coming.

The only way to ensure you’re perfectly positioned when this all comes to a head…

Is to take action now, BEFORE the crisis hits the mainstream news.

With this risk-free offer, you have nothing to lose… and so much to gain.

So what are you waiting for?

To get started with your heavily discounted subscription to Strategic Intelligence…

And to claim everything I’ve promised above…

Simply click the button below.

SUBSCRIBE NOW

Sincerely,

Jim Rickards

February 2018

P.S. I just heard that Bank of America, Citigroup, JP Morgan Chase, Discover and Capital One have all BANNED Bitcoin purchases with the use of their credit cards. It’s just a matter of time before the whole house of cards comes crashing down… sending the broader financial markets into crisis mode. Don’t wait until April 17 to protect your finances… let me do all the hard work for you as a member of Strategic Intelligence. Again, with this heavily discounted, RISK-FREE offer, you have nothing to lose and so much to gain. Simply hit the button below to get started.

SUBSCRIBE NOW

P.P.S. Already in the last few days, Bitcoin has plunged from $10,288 to $6,564… a loss of more than 36%… while the Dow Jones has plummeted more than 1,800 points!

There’s not much time left to act. We’re already seeing the collapse starting to happen.

Don’t wait — simply hit the button below to get started.

SUBSCRIBE NOW